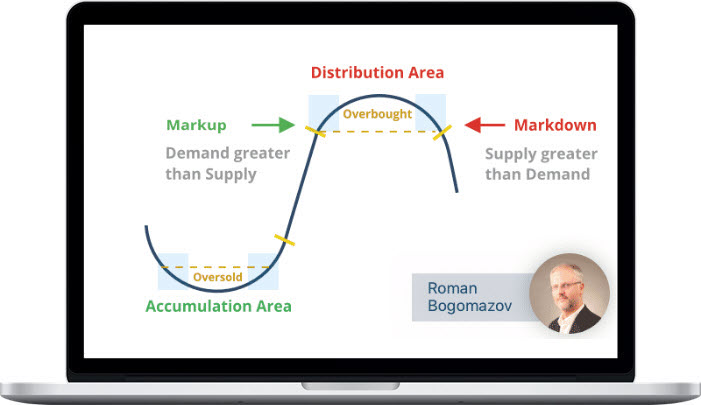

Wyckoff Analytics – Wyckoff Trading Course Part 1 (Fall 2021)Understand the laws, principles and techniques developed by Richard Wyckoff to track and trade in harmony with the big money, represented today by investment banks, hedge funds, pension plans and other large institutions.Use practical tools to apply this timeless methodology; by learning to “read the market” you can trade alongside large institutions that generate (and stop) big trends.Anticipate market direction through analysis of price, volume and time, without the need for additional indicators.What You’ll Learn In Wyckoff Trading Course Part 1?Sessions 1-5 : Marketstructural analysis. In this segment, you will learn to:Identify the all-important Change of Character in the price and volume of the market or of an individual security, allowing you to anticipate when it will move from a trending to a non-trending environment, and vice versaUnderstand the current price structural environment and its implications for trading at any given timeRecognize key Wyckoff Events, such as buying and selling climaxes, springs, upthrusts, signs of strength or weakness, last points of support or supply, and moreDistinguish Wyckoff Phases, which signify predictable developments in all trading ranges (and in all time frames), and allow you to spot when a new trend is about to emerge, so that you can place trades accordinglySessions 6-10 : Supply and demand. In this course component, you can learn to “read the market” on any chart through:Volume and price analysis, a visual application of Wyckoff’s principle of contrasting effort (volume) vs result (price movement) to understand what the larger market participants are doing and what they probably intend. This segment will comprise:Bar-by-bar as well as swing-by-swing analysis of price and volumeAnalysis of volume patterns in different Wyckoff PhasesUsing historical analogues to compare recent price bar spread and volume with previous events, which can provide additional clues about the direction and character of future price movementSessions 11-12Relative and comparative analysis. Another foundation of the Wyckoff Method involves comparing the performance of a stock, ETF or another security with that of the overall market or another instrument, helping you identify trade candidates that are likely to outperform both their peers and the overall market. Elements of this segment include:Relative and Comparative Analysis as an institutional signature of accumulation or distributionFdentifying “Sweet spots” of outperformance as a predictor of future price behaviorFiltering and scanning for relative outperformance characteristicsSession 15 Q&A sessionTrade Management. Clear recognition and best practices regarding entry and exit points, stop-loss placement and movement, and proper scaling in and out of positionsAbout Wyckoff AnalyticsRoman BogomazovRoman Bogomazov is a trader and educator specializing in the Wyckoff Method of trading and investing, which he has taught for more than ten years as an Adjunct Professor at Golden Gate University and as the principal instructor at WyckoffAnalytics.com. He is the founder and President of Wyckoff Associates, LLC, an enterprise providing online Wyckoff Method education to traders throughout the world (www.wyckoffanalytics.com). Using WyckoffAnalytics.com as a thriving trading community platform, Roman has developed a comprehensive educational curriculum covering basic to advanced Wyckoff concepts and techniques, as well as visual pattern recognition and real-time drills to enhance traders’ skills and confidence.A dedicated and passionate Wyckoffian, he has used the Wyckoff Method exclusively for his own trading for more than 25 years. Roman has also served as a Board Member of the International Federation of Technical Analysts and as past president of the Technical Securities Analysts Association of San Francisco.More courses from the same author: Wyckoff Analytics

Kim Krompass – Price Action Traders Institute (PATI)

₹2,512.00

Kim Krompass – Price Action Traders Institute (PATI)

₹2,512.00

Uprise Academy – FX Masterclass 2.0

₹2,009.00

Uprise Academy – FX Masterclass 2.0

₹2,009.00

Wyckoff Analytics – Wyckoff Trading Course Part 1 (Fall 2021)

₹26,995.00