Tom Alexander – New Foundations for Auction Market Trading

The New Foundations for Auction Market Trading and Trade Plan Development Course provides a comprehensive and intense course in trading Auction Market Concepts / Market Profile. The course ers thorough and practical training on our methodology that is based on Auction Market Concepts. It may be the only course available that puts Market Profile into the perspective for which it was originally intended, and it covers in detail the history and evolution of Market Profile. Any “Market Profile” trader, or anyone that is considering using Market Profile in any way in their trading should take this course.

This course distills the principles for trading Auction Markets based on my thirty-five years of trading and research, and shows in detail how to apply the methodology.

The many benefits of taking this course include:

It provides a comprehensive worldview of how markets develop that is logical and objective which addresses the confidence level necessary to execute the trade plan.

It is robust; it provides the ability to trade any market and any time frames using the exact same techniques (strategies and tactics).

It inherently orients the trader to identifying trades that have a positive expectancy, which all trade plans/models MUST have.

It provides definition and structure – something almost all discretionary trades struggle with.

COURSE DETAIL

Part One ( 3 hours)

We are going to breakdown the business of trading and define exactly what we are trying to do as traders. We will expose and eliminate a lot of popular market myths, including those surrounding “Market Profile”.

A breakdown of the basics of trading.

Exactly what are we trying to do?

Why is it so difficult to trade?

Common Practices that must be avoided.

Simple steps to immediately improve your trading.

Developing the proper mindset through a “best practices” checklist.

Habits all long-term, successful traders have in common.

Habits all perpetually losing traders have in common, and the cure.

The background and evolution of Market Profile.

Part Two (2 hours 30 min)

We will thoroughly breakdown Auction Market Principles and explain why this is such an extraordinarily powerful approach to trading. We will explain the Auction market concept of VALUE and its role in Auction Markets. We are going to explain the logic behind the concept and how the market follows a very consistent process of development. We will demonstrate why the market has to follow certain patterns of development. We will explain the Market Profile graph and what it was originally designed for.

The misuse of the Market Profile is almost universal among “Market Profile” traders. You will learn the effective way to use it. You will learn the importance of the information provided by a bar chart and how to use bar charts effectively. You will learn why indicators obfuscate the incredibly important information bar charts provide.

Market Profile Graph Analysis

Bar Chart Analysis

Auction Market VALUE

What indicators are telling us.

The Market Development process

How to filter timeframes to define the greatest reward to risk opportunities

You will learn where and when to trade (and why)

You will learn where and when NOT to trade (and why)

Part Three (2 hours 41 min)

In Part 3 we will teach you the concept of trading Market Condition. Now you will really begin to see both the theoretical and the practical difference between those that are successful and those that are not, and why, and how you are becoming a very different trader from the crowd.

What is Market Condition?

What is price based trading?

Why is trading Market Condition essential?

The two phases of Market Development

The three-step market development process

The Balance Area and its simple, yet profound implications for trading

Understanding two-sided trading verses one-sided trading

Balance Areas and how to trade them

Volume: Horizontal scale and Vertical Scale

Part Four (3 hours)

In part four we cover in detail trade set-ups. We will look at trade set-ups across all degrees of time.

How do short-term and long-term trade set-ups differ? How do you determine stop placement?

How do you determine trade targets?

How do you enter a trade?

How do you exit a trade.

How to develop consistency and objectivity.

How to filter your trades

Part Five (2 hours 48 min )

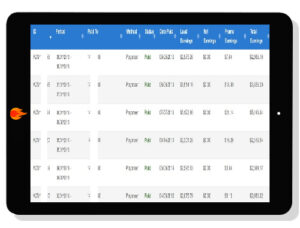

In this section we will cover expectancy and the use of leverage. Traders always want to know: “How much can I make trading”. We are going to show you exactly how to determine that and the process you must follow to avoid losing your trading capital.

The balance between the percentage of winning trades and the ultimate goal of expectancy.

How to manage and build the smaller account.

The quickest way to build the small account.

How to add “alpha” to a large portfolio – this is addressing the need of the relatively high net worth individual who wants to generate a good return without the typical equity swings associated with futures trading.

Part Six (2 hours 16 min)

In part 6 we will go through several case studies in different markets and different timeframes. We will look at numerous examples across all timeframes, from very short-term day trade situations to very long term charts and how those can be an incredibly important guide in your long-term trade planning.

Which are the best markets to day trade?

When to avoid trading a market, and why.

Practical aspects of money management and trade management.