Wyck Analytics – Momentum, Volume And Price Structure A New Integration Of Theory And Price

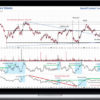

Price Structural Analysis plays a central role in the Wyck Method, and rightfully so. As Wyckians, we want to observe price and volume behavior in order to understand institutional motives expressed through trading range phases.

Understanding the intentions and market activities of large operators allows us to anticipate and capitalize on near- and longer-term momentum moves. Traders who can read these institutional signals can capture outsized momentum-based profits in both swing trades and campaigns.

In this course, Roman will explore how MOMENTUM and VOLUME – indicators of institutional presence – influence the evolution of Price Structures. We know that the Composite Operator establishes significant positions within trading ranges before allowing price to be marked up or down.

Although this process occurs within a potentially infinite diversity of trading ranges, the forces exerted by institutional activity generate similar patterns of momentum and volume if you know what to look for.

What You’ll Learn In Momentum, Volume And Price Structure A New Integration Of Theory And Price?

MOMENTUM allows us to observe the movement of big money in and out of stocks. We can detect short- and long-term changes in momentum that lead to specific price structural changes. We will construct sequences of momentum events that recur throughout the evolution of trading ranges – from Phases |A| to |E| – including stopping action, absorption, testing, and emergence of synchronicity between Effort and Result. We will also analyze the development of momentum in each phase, as well as how long-term momentum develops from short-term momentum, allowing us to assess whether a change of behavior is sustainable.

VOLUME increases and extremes represent conspicuous confirmations of institutional buying and selling. Combined with a key momentum definition and an understanding of price structures, variations in volume expose changes in institutional Effort and can act as an excellent timing tool for both swing and longer-term trades.

PRICE STRUCTURE manifests specific behaviors by institutions in different Phases. These behaviors can be visualized through momentum and volume. We will combine all of our observations into one logical path of how Accumulation or Distribution unfolds based on price structure, momentum and volume.

About Instructor

Roman Bogomazov is a trader and educator specializing in the Wyck Method of trading and investing, which he has taught for more than ten years as an Adjunct Professor at Golden Gate University and as the principal instructor at WyckAnalytics.com.

He is the founder and President of Wyck Associates, LLC, an enterprise providing online Wyck Method education to traders throughout the world (www.wyckanalytics.com). Using Wyck Analytics as a thriving trading community platform, Roman has developed a comprehensive educational curriculum covering basic to advanced Wyck concepts and techniques, as well as visual pattern recognition and real-time drills to enhance traders’ skills and confidence.

A dedicated and passionate Wyckian, he has used the Wyck Method exclusively for his own trading for more than 25 years. Roman has also served as a Board Member of the International Federation of Technical Analysts and as past president of the Technical Securities Analysts Association of San Francisco.