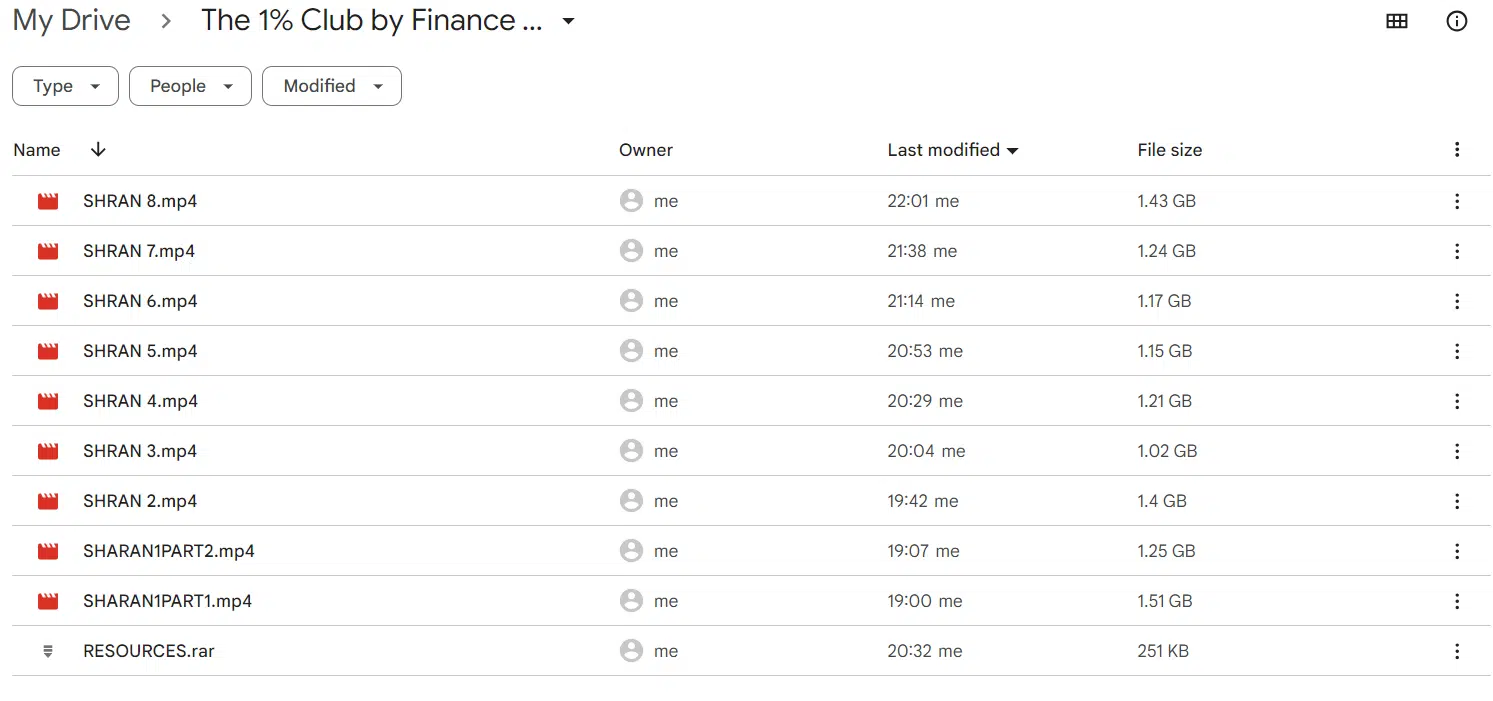

The 1% Club by Finance With Sharan Full Course

IMPORTANT MESSAGE

WE ARE GIVING HIS REAL COURSE NOT THE MASTERCLASS . PRICE OF REAL COURSE IS 5000RS . DONOT COMPARE IT WITH MASTERCLASS

Sharan has consolidated his knowledge into

The 1% Club.

Start with the Basics: Introduction to Financial Planning

First unlearn some of the bad financial advice you’ve been exposed from family, friends and media.

Then you will dive into understanding how to decide your financial goals – short-term, mid-term, and long-term. And you’ll learn about all the different asset classes available to you to achieve these goals.

You will get access to all my finance tools to make these decisions in less than a minute.

By the end of this module, you will be able to clearly define your financial goals before we start investing for it.

Financial Planning Intermediate

I will reveal the optimal asset allocation strategies that PROFESSIONAL wealth managers use for the ULTRA RICH

Then we will dive into understanding how to decide your financial goals

Then we will dive into understanding how to decide your financial goals

You will get access to all my finance tools to make these decisions in less than a minute.

By the end of this module, you will be able to clearly define your financial goals before we start investing for it.

Financial Planning Advanced – Mutual fund selection, Real estate investing, Gold Investing

How I select mutual funds under the debt and equity category?

I’ve created this methodology after talking to close to 3-4 certified financial planners who handle money for the ultra rich and also fine-tuned it by talking to mutual fund managers themselves.

The methodology has been simplified for you in the form of an excel tool.

There are more than 3000 mutual funds today. With the help of this tool, you will be able to select the right ones for you in less than 5 mins. I will also tell you which mutual fund categories to avoid. I will also tell you when to exit the mutual funds.

I will also explain how to invest in gold, real estate and other alternate asset classes to create a complete risk-adjusted investment portfolio which will give you a good night’s sleep no matter what the market condition is.

Health is Wealth : Insurance Planning

All the different kinds of health insurance available in the market

How to select a health insurance that suits your needs through a case study?

How to purchase health insurance for your parents with a live demo?

How to save thousands of rupees when purchasing health insurance?

Life Insurance

Planning That LIC won’t want you to know!

Whether you need a life insurance in the first place

How to get out of bad policies you have entered in the past?

How to select the best policy for you with a live demo, along with relevant riders?

Tax Planning Basics : Understanding What The Hell Your CA is Talking About!

The different types of taxes. How does tax (income tax, GST etc) get calculated?

How to optimize your tax savings as a salaried employee? Hacks for Business owners to reduce tax.How to plan your 80C? How your spouse and kids can save you taxes? How your parents can help you save taxes? How to use your employer to save taxes?

How to pay less tax to the government? The game of exemptions and deductions.

Case study on how to pay zero taxes

Tax Planning Advanced: Congrats! You are now almost a CA!

How to do tax planning for you investments?

How to hack the system legally to reduce your taxes?

All tax planning lessons for advanced learning