MasterTrader – Master Trader Option Strategies Below are the 10 Modules for this Option Strategies Series, which have been artfully created to take you on an educational Journey to Option Trading Mastery! I. Foundation of Options Trading and MarketsIntroduction to OptionsCall and Put Options and When UsedUnderstanding Option Terminology and Quote ScreenUsing Technical Analysis With Option TradingIII. Mastering Covered Calls for Monthly Income and Boosting ReturnsCovered Calls Defined and Risk GraphBuying Covered Calls as Mildly Bullish Directional TradeSelling Calls Against Holdings for IncomeSelling Calls Against Holdings to Reduce Cost BasisSelecting Optimal Strike and ExpirationBuying Covered Puts as Mildly Bearish Directional TradeV. Option Strategies for Bearish Directional TradesBuying Puts as Bearish Directional TradeSelecting Optimal Strike and ExpirationBear Put Spreads as Mildly Bearish Directional TradeBear Diagonals as Bearish Longer Term Directional TradeManagement Strategies1VII. Option Strategies in Sideways Markets and Explosive MovesShort Straddles and StranglesLong Straddles and StranglesShort Iron Condors for Range Bound MarketsIron ButterfliesNumerous Examples, Plus Management StrategiesIX. Trade/Money Management and Adjustment StrategiesMoney ManagementAdding or Adjusting Positions as Bias ChangesLegging Into Iron CondorsDefensive and Offensive Rolling TechniquesRolling Option Strikes Up/Down as Bias ChangesRolling Option Expiration Up/Down as Bias ChangesRepair StrategiesII. Basics of Time Decay, Volatility, and Timing for Option TradersOptions Pricing and the “Greeks”How Theta (Time Decay) Provides Edge to Option SellersVIX (“Fear Index”), High IVR, and Timing for Option SellersNormal Distribution and Probability of Profit0IV. Option Strategies for Bullish Directional TradesBuying Calls as Bullish Directional TradeSelecting Optimal Strike and ExpirationBuying Bull Call Spreads as Mildly Bullish Directional TradeBuying Bull Diagonals as Bullish Longer Term Directional Trade}VI. Selling Options for Income Generation and PaycheckSelling Naked PutsSelecting Strike Price/ExpirySelling Bull Put SpreadsSelling Naked CallsSelling Bear Call SpreadsNumerous Examples, Plus Management StrategiesiVIII. Trading Options on Gaps and News StocksTrading NewsTrading GapsPro GapsNovice GapsHigh IVR PatternsX. Psychology, Trading Plan, Miscellaneous, and Bringing it All Together!Discipline/PsychologyTrading PlanMiscellaneous TopicsReview of Strategies in 4 StagesTest Your KnowledgeConcluding Thoughts and Next Steps!

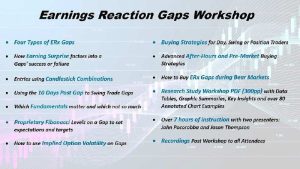

John Pocorobba – Earnings Reaction Gaps Workshop

₹2,185.39

John Pocorobba – Earnings Reaction Gaps Workshop

₹2,185.39

Simpler Trading – Predict Time and Price Changes With ‘Timing Mastery’

₹1,191.05

Simpler Trading – Predict Time and Price Changes With ‘Timing Mastery’

₹1,191.05

MasterTrader – Master Trader Option Strategies

₹3,974.04