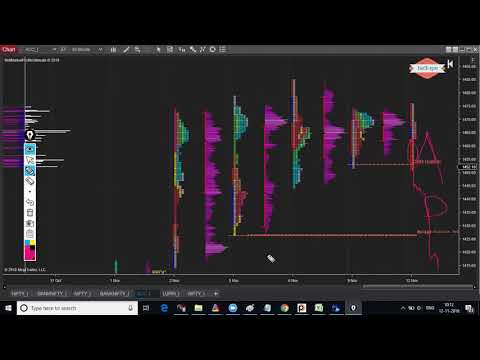

This Mentorship program solely focuses on Market Profile and Orderflow tools using Ninjatrader 8 software to make the traders help understand the objective way of look into short-term and intraday trading opportunities.

File size: 12.49GB

MarketCalls.in – Tradezilla 2.0

This Mentorship program solely focuses on Market Profile and Orderflow tools using Ninjatrader 8 software to make the traders help understand the objective way of look into short-term and intraday trading opportunities.

The course is designed in such a way that even traders who are new to technical analysis can understand as the course starts from the scratch of market profile and order-flow concepts.

Market Profile Basic

Introduction to Auction Process and Auction Market theory

Introduction to Market Profile / Volume Profile

Basic Building Blocks of Market Profile (TPOs, Initial Balance, Value Area, Point of Control, Tails, Range Extension)

Importance of Balance and Excess

Importance of Point of Control and Value Area

Market Profile Structure and Profile Distribution types

Importance of single prints

Understanding poor Structures, Poor Lows/Poor High, Weaker Low, Weaker High

Importance of Anomalies and Emotional profile structure

Importance of 45 degree line

Importance of Failed Auction

Importance of Spikes and Gaps

Understanding the behavior of Market Participants

Market Opening confidence Types

Importance of One timeframing and the underlying market confidence

Market Profile Intermediate

Multi-timeframe Top Down Analysis (barcharts)

Multi-timeframe volume profile analysis

How to understand Market Confidence for routine day trading or positional trading

Market Profile Key Reference levels (Intraday & short-term)

Introduction to Trading Inventory

Where trading money keep their stop-loss

Identify Strong Auction Process and Weaker Auction Process

Signature G2/G3 Patterns, R-PPOC levels, AB Poor lows

Look above the balance and fail, Look above the balance and accelerate

How to prepare for a trading day(Top Down analysis, Pre Market Analysis)

Checklist for Day Trading preparation, Key levels to monitor)

Initiative Vs Responsive Auctions

How to spot acceptance/rejection at key reference levels.

Market Profile Advanced

30+ Intraday Trading Techniques

Market Profile Positional Trading techniques

Top/Bottom Formation Setups

Short Covering/Long Liquidation Patterns

How to think from Exponential odds

How to manage risk while taking a view using market profile

Live Case Studies on Nifty/Bank Nifty and Top Nifty scrips

Ninjatrader 8 and Market Profile Settings

Understanding Ninjatader 8 and Datafeeds

Understanding Ninjatrader 8 settings

How to setups charts and optimal TPO size

Bell Market Profile Pro and Bell Market Profile Ultimate Settings

How to use Bell Market Profile Ultimate Scanners

Learn to use Bell Dynamic Profile Settings

How to use Bell Trend Analyzer along with G2/G3 patterns

Orderflow Trading Strategies – Basic

Basic Building Blocks of Orderflow, Delta, Cumulative Delta

Different representation of Orderflow views and its importance

Features of Bell Orderflow Ultimate and Settings

Lesson 4 : The commitment of Traders and Contract Reversals Explained

Types of Data Vendors and their data formats

Difference between Level 1, Level 2, Level 3 and Tick by Tick Feed

How Orderflow is plotted using uptick/downtick or BidxAsk methods

Difference between Orderflow and Bookmap

Introduction to Market Depth 101

Difference between liquidity and volume

L: How high liquidity and low liquidity affects the markets

What to Interpret from High volume nodes and Low volume nodes

Institutional Execution strategies

Principles of Orderflow

Importance of Stacked Momentum Buyers

Orderflow Trading Strategies – Advanced

How Smart money positioning and Unwind their positions

How to spot stop-hunting / Where most traders keep their stoploss

How to Identify Initiative Drive and Absorption auctions

How to Identify Trend reversals for scalping using orderflow

How to Identify very short term support and resistance levels

How to Identify failed breakout trading strategies for Intraday trading

How to Identify trend breakout trading strategies for Intraday trading

Momentum Trading and Momentum Exhaustion Trading Patterns

How to combine momentum exhaustion with Delta Divergence

Spotting Cumulative Delta Divergence

How to Identify Trapped Buyers or Trapped Sellers from Orderflow

How to make use of Unfinished business concepts

How to interpret R-Delta and MR – Signals from Orderflow

Which timeframe to use in Orderflow for scalping/intraday trading

Trading notes and Best Orderflow trading practices

Get MarketCalls.in – Tradezilla 2.0 download immediately on AMZLibrary.com!