Wyckanalytics – Beyond Springs And Upthrusts Significant Bars And Horizontal Volume

This course is a follow-up to High-Probability Wyck Trade Set-Ups and Volume-Price Analysis which generated many thoughtful email inquiries about the materials covered by Gary Fullett and Roman Bogomazov.

These questions included analysis of effort vs result as well as springs and upthrusts in different market conditions. To address some of the most important questions in-depth, Roman ered two follow-up webinars, during which he presented additional new information to help you take advantage of these frequently occurring trade opportunities.

What You’ll Learn In Beyond Springs And Upthrusts Significant Bars And Horizontal Volume?

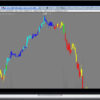

Identification of high-probability springs and upthrusts on daily and intra-day charts in the established up or down swing

Using intra-day data to enhance timing of entries and exits in trading springs and upthrusts on a daily chart

Distinctions in trading tactics for springs and upthrusts in uptrends vs downtrends vs consolidations

Markedly improving the results of trading springs and upthrusts through the use of: (1) Significant bar analysis, and (2) Horizontal volume bars [market profile]