Jordan Belfort: The Investing Wolf

Few names in the world of banking and investments inspire as much curiosity and motivation as Jordan Belfort, a.k.a. the Wolf of Wall Street. His is a complex story of ambition, cunning, and fortitude rather than merely one of luxury and excess. This piece unravels the techniques that turned Jordan Belfort into a financial legend and explores the lessons that investors may take away from his path.

The Ascent of a Titan in Trading

Jordan Belfort started his career in finance during Wall Street’s explosive expansion and fierce rivalry in the late 1980s. Belfort made a name for himself fast with his aggressive sales tactics and distinctive style of stock market investing. He established the brokerage company Stratton Oakmont, which would grow to be the hub of his financial empire. Belfort rose to the top of the financial industry because to his creative strategies and endearing demeanour.

Understanding Belfort’s Investing Methods

Even though Belfort’s strategies generated controversy, they provide important insights into the art of investing. He highlighted the significance of comprehending market psychology, a talent that enabled him to foresee and profit from market developments before the typical investor could. Belfort’s method of risk management was also remarkable. Few people could equal his level of accuracy in walking the tightrope between high-risk and high-reward ventures.

The Mentality of Investment Sales

Belfort’s understanding of sales psychology was the key to his success. In the realm of investments, the ability to persuade, motivate, and convince others is highly valued. A major contributor to the success of his company was Jordan Belfort’s ability to explain intricate financial ideas in understandable, straightforward words. His sales psychology techniques are still applicable to both investors and salespeople, demonstrating the need of clear communication in the financial industry.

The Fall and Redemption’s Teachings

Belfort’s tale includes both failure and atonement in addition to achievement. His downfall, which was accompanied by legal disputes and personal hardships, teaches important lessons about the value of moral behaviour in the financial industry. It draws attention to the negative effects of unbridled ambition and the need of following regulations. Belfort’s efforts in financial education and motivational speaking during his latter years demonstrate his adaptability and capacity for self-reinvention.

Influence on Contemporary Investment Methods

There is no denying Jordan Belfort’s influence in the world of investments. His trading and investing methods, especially in the areas of sales and market psychology, have impacted a new wave of investors. The tale of The Wolf of Wall Street is both inspirational and cautionary, serving as a reminder of the value of creativity, moral behaviour, and ongoing education in the constantly changing banking industry.

The Impact of The Wolf on Modern Finance

Belfort’s influence is still felt in many facets of the financial sector today. His impact is seen in everything from the operations of brokerage businesses to the training of sales staff. His tale has also highlighted the need for stronger regulatory frameworks to promote a more ethical and transparent financial environment and to stop the excesses of the past.

In summary

The Wolf of Investing, Jordan Belfort, is still a complicated character in the financial world. His tale combines genius, scandal, fall from grace, and salvation. Investors and lovers for money may learn a great deal about strategy, psychology, and ethics from the life of Jordan Belfort. His legacy is still felt throughout the financial industry, serving as a constant reminder of the value of resilience and the need to learn from the past.

Stock Learners – Game of Trading Intraday and Swing Course

₹899.00

Stock Learners – Game of Trading Intraday and Swing Course

₹899.00

Prince – Maths Trading Course (Gann)

₹699.00

Prince – Maths Trading Course (Gann)

₹699.00

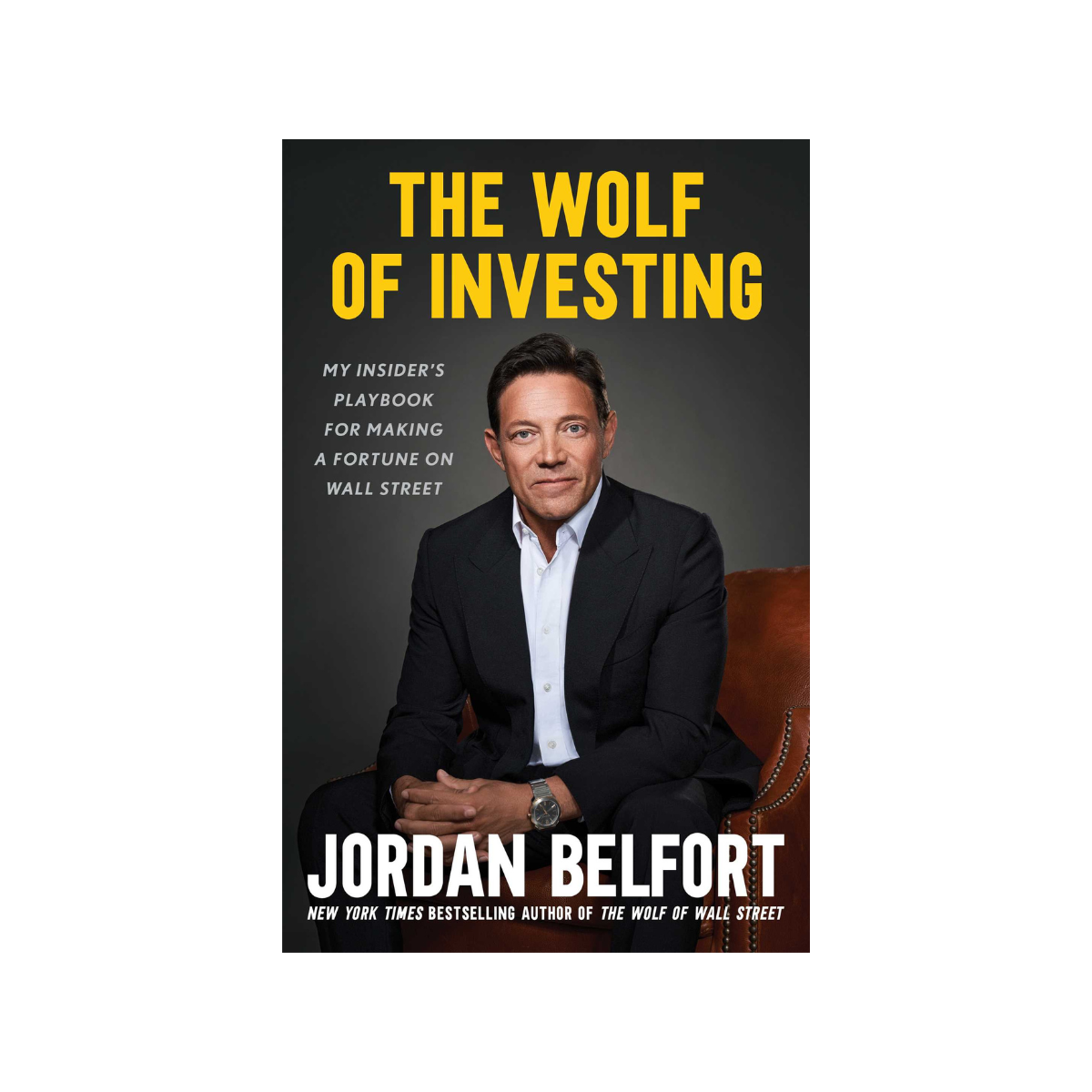

Jordan Belfort – The Wolf Of Investing

₹4,150.00