VAGAFX – Vaga Academy

Learn a Revolutionary Single-Timeframe Blueprint for Orderflow & Market Structure Never Before Used by Retail Traders.

The Retail Trading scene is overcrowded by false information, outdated practices and fake mentors who know it is easier to make money by teaching you how to trade rather than trading themselves. You have likely picked up bad habits without realising and may be failing at trading for one of these following reasons

UNEDUCATED RISK MANAGEMENT.

You are risking too much capital per trade. Not closing your trades when you should. Poor profit taking sense and stop loss placement.

LACK OF STRATEGY AND DISCIPLINE.

You don’t have a clearly defined and tested trading plan. You don’t stay true to your plan and make decisions based on discretion.

POOR TRADING PSYCHOLOGY.

You make decisions based on your emotions. Not closing trades in euphoria, Not entering a trade due to fear or revenge trading.

LOW QUALITY TRADING STRATEGY

You haven’t back-tested your plan or the markets you’re trading, or, using a strategy with low strike rate and consistency.

The strategy we er has been moulded by failure into a dynamic methodical approach to trading the market with conistent profits and total clarity. Tested over years of market data, we will teach you how to markup, and think like an expert, and how to enter positions at the same levels as the largest players in the market.

EDUCATED RISK MANAGEMENT.

We will show you how to protect your account capital whilst allowing your total equity to compound and grow. No longer will you run the risk of blowing an account or hitting drawdown restrictions.

STRICT RULES DRIVEN APPROACH.

We will provide you with a strict set of easy to follow rules which can be applied quickly to any market at any time. The strategy is designed to stop you from using your own discretion to make decisions.

CORRECT TRADING PSYCHOLOGY

We will show you the correct thought processes and processes to minimise emotional based decisions. The strategy stops over-trading by simply providing no set- ups in periods of low volume and volatility,

TESTED AND PROVEN STRATEGY

We will not only provide you with a strategy that has withstood the tests of time and provided consistent profits for years, but we will also show you how to backtest yourself.

What You’ll Learn In Vaga Academy?

UNIQUE SINGLE TIMEFRAME APPROACH

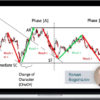

Multi-timeframe analysis has introduced many problems into retail trading (see Below) Learn how to dissect the market on a single timeframe whilst still trading with long term order-flow, lowering workload, increasing analysis quality, and back-testing capability.

SIMPLE METHODICAL RULESET

A rule set tested and traded for years with consistent returns. Learn how to mark up the chart quickly every day, knowing what to look for and what to avoid. Achieve unparalleled consistency with a repeatable simplistic routine with minimised chart time.

DYNAMIC VAGA BLUEPRINT

Learn how to dissect the market by differentiating between minor, major and swing structure types to determine short, medium and long term order-flow for ultimate directional perception, with the ability to trade with multiple bias at the same time.

QUALITATIVE MARKET DISSECTION

Each concept is built on the foundational mechanics that make and move every market, providing a never before seen depth of clarity when looking at a chart. In-depth knowledge of imbalance, order-flow, market structure, liquidity and more.