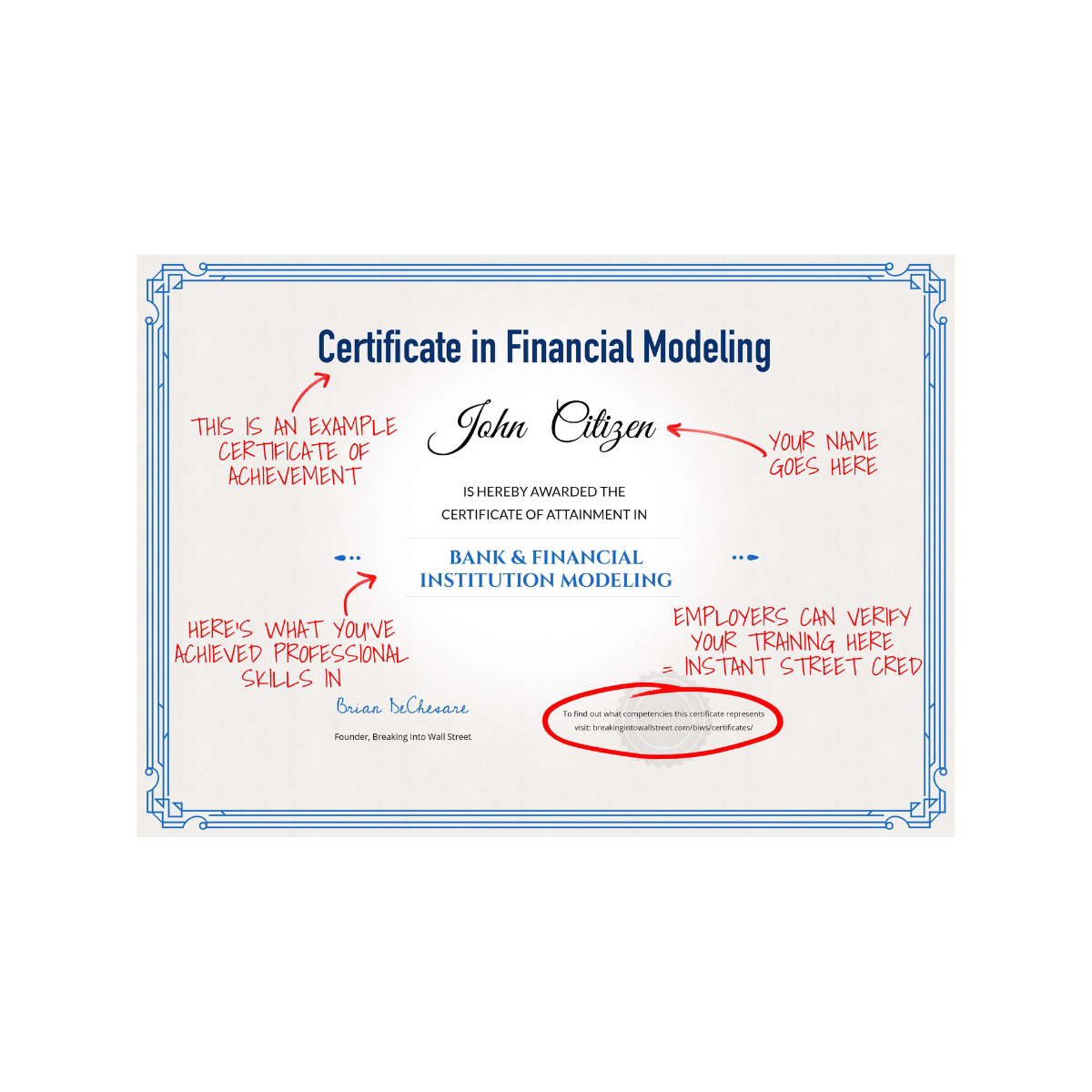

Overview of Breaking Into Wall Street – BIWS Bank & Financial Institution Modeling

In diving deeper into the world of finance, Breaking Into Wall Street (BIWS) offers an unparalleled Bank & Financial Institution Modeling course. This course stands as a cornerstone for individuals aiming to excel in financial modeling, specifically tailored for the banking and financial institutions sector. It teaches the ins and outs of creating meticulous financial models that can predict the financial performance of banks and similar institutions under various economic scenarios. Through BIWS, learners gain access to a comprehensive suite of tools and video tutorials that detail step-by-step processes for constructing models based on real-world case studies. These case studies cover key components such as understanding a bank’s unique financial statements, projecting net interest income, and evaluating regulatory capital requirements. My experience with BIWS has shown me that its pragmatic approach not only sharpens technical skills but also enhances one’s understanding of the complexities within the banking sector. This course is particularly beneficial for those looking to break into investment banking, equity research, or portfolio management, where such skills are in high demand.

Course Structure and Content

In the BIWS Bank & Financial Institution Modeling course, I find the structure meticulously designed to cater to a diverse learning appetite. The course kicks off with foundational concepts, where trainees grasp the basics of financial modeling tailored specifically to banks and financial institutions. This includes understanding the unique financial statement formats used by banks compared to other corporations. Modules progress to cover net interest income analysis, an essential aspect of bank profitability, illustrating how slight adjustments can significantly impact predictions and evaluations.

Also, the course dives deep into projecting and stress testing a bank’s financials, which involves analyzing how external economic variables influence a bank’s performance. This segment is instrumental for anyone looking to work in environments that require a keen eye for risk assessment and financial forecasting. A substantial part of the content also focuses on regulatory capital frameworks like Basel III, detailing how these regulations affect banks’ operations and lending capabilities.

What sets this course apart are the case studies modeled after real-world scenarios, which sharpen one’s ability to apply theoretical knowledge practically. Each section concludes with these examples, reinforcing learned concepts and ensuring I can navigate the complexities of bank financial modeling with confidence. As I progress, I appreciate the incremental challenge each module presents, guaranteeing a comprehensive mastery of the subject matter by the course’s completion.

Learning Outcomes

Upon completing the BIWS Bank & Financial Institution Modeling course, I’ve identified several key skills and knowledge areas participants are expected to master. Firstly, learners gain a solid foundation in the unique financial statement formats specific to banks, which is crucial for accurate financial modeling. This includes understanding the intricacies of net interest income and how it affects a bank’s profitability. Secondly, the course equips students with the ability to project and stress-test a bank’s financials under various economic scenarios, a skill that’s invaluable for risk assessment and strategic planning. Thirdly, participants will learn about regulatory capital frameworks, including Basel III, ensuring they can navigate the complexities of compliance and its impact on bank operations. Finally, the practical application of concepts through real-world case studies ensures that by the end of the course, learners can confidently create detailed financial models, predict bank performance, and make informed decisions in the finance industry. This comprehensive skill set enhances one’s ability to compete in the demanding field of finance, particularly in roles focused on banking and financial institutions.

Ease of Use and Accessibility

Exploring through the Breaking Into Wall Street (BIWS) Bank & Financial Institution Modeling course, I’ve found its ease of use and accessibility standout features. The course platform is intuitively designed, making it simple for learners to access materials at any time, from any location with an internet connection. Clear, step-by-step video tutorials guide users through each module, ensuring concepts are easy to understand and apply.

Also, BIWS ensures learners aren’t overwhelmed by the complexity of bank modeling. The course is structured to cater to both beginners and those with some experience, breaking down sophisticated financial modeling processes into digestible, manageable sections. Content organization enhances learning, with modules logically sequenced to build on one another.

Accessibility extends to course materials, which learners can download for offline study. This flexibility means that regardless of a user’s schedule, they can engage with the content at a pace that suits them, repeating lessons if necessary to reinforce understanding.

In essence, BIWS has removed barriers to entry for those aspiring to master bank and financial institution modeling, making it an invaluable tool for anyone looking to advance in the finance sector.

Comparing BIWS with Other Financial Modeling Courses

In evaluating Breaking Into Wall Street (BIWS) Bank & Financial Institution Modeling against other financial modeling courses, I find several unique aspects that set BIWS apart. First, its focus on the banking sector provides a specialized understanding not often covered in generic financial modeling programs. While many courses offer broad financial modeling training, BIWS dives deep into bank-specific financial statement formats, regulatory frameworks like Basel III, and net interest income analysis, essential for anyone aiming to excel in finance roles related to banking.

Second, BIWS’s real-world case studies enhance learning, offering practical experience that bridges theory with actual industry practices. This hands-on approach ensures learners not only grasp theoretical concepts but also apply them in real-world scenarios, a competitive edge I consider invaluable.

Also, BIWS prides itself on flexibility and accessibility. The platform’s design is intuitive, catering to users from varied backgrounds. Whether a beginner or someone with some experience, BIWS structures its content to enhance understanding gradually. The ability to download materials for offline study allows learners to progress at their own pace, a feature not always available in other courses.

In comparison, other financial modeling courses might provide a broader overview of modeling concepts applicable across various industries. But, for those specifically interested in the intricacies of banking and financial institutions, BIWS offers more targeted, in-depth learning materials. This specificity, combined with user-friendly course design and practical case studies, makes Breaking Into Wall Street a standout choice for individuals focused on mastering bank and financial institution modeling.

Pros and Cons

When considering the Breaking Into Wall Street (BIWS) Bank & Financial Institution Modeling course, it’s important to evaluate both its advantages and disadvantages.

Pros

Specialized Focus:

The course’s targeted approach on banking and financial institution modeling sets it apart. It goes in depth into unique financial statement formats specific to banks and other financial institutions.

Real-World Case Studies:

BIWS emphasizes practical learning through case studies that model real-world banking scenarios, enhancing one’s understanding of net interest income analysis and stress testing.

Flexible Accessibility:

Offering self-paced learning, this course caters to various schedules, allowing learners to progress at their own speed.

Regulatory Frameworks:

It covers essential regulatory capital frameworks like Basel III, crucial for anyone looking to work within or alongside regulatory environments.

Niche Focus Limits Breadth:

While the specialization in banking is a strength, it might not cater to those seeking a broader understanding of financial modeling across various industries.

Cost:

The investment in this course might be significant and could be a con for individuals or students on a tight budget, considering there are free resources available, though less specialized.

Summarizing, the BIWS Bank & Financial Institution Modeling course is an exceptional resource for individuals aiming to elevate their expertise in finance, specifically within the banking sector. Its focused content, practical case studies, and flexible learning environment make it a valuable tool. But, potential learners should consider the cost and specialized nature of the course relative to their broader career goals or learning needs.

Success Stories and Testimonials

In examining the impact of the Breaking Into Wall Street (BIWS) Bank & Financial Institution Modeling course, testimonials highlight its instrumental role in users’ career advancements. Individuals report mastering financial modeling techniques specific to the banking sector, a skill that has directly facilitated job placements in prestigious financial institutions. For example, one user attributes their successful transition into investment banking to the course’s comprehensive coverage of financial valuation and merger models. Another points to the detailed case studies as pivotal in their understanding of complex regulatory frameworks like Basel III, setting them apart in interviews. Graduates often emphasize the course’s practicality, noting how the real-world examples and hands-on exercises prepared them for demanding roles in finance. Besides, many have appreciated the flexibility in learning pace, allowing them to balance course work with professional commitments. Overall, these stories underscore the course’s effectiveness in equipping individuals with the tools needed to excel in the finance industry, as confirmed by their significant career achievements following completion.

Conclusion

Embarking on the BIWS Bank & Financial Institution Modeling course is a strategic step for anyone serious about carving out a successful career in finance, especially within banking sectors. It’s clear that the course’s strength lies in its practical approach, blending in-depth content with real-world applications. The testimonials and success stories serve as a testament to its effectiveness, illustrating how it prepares students not just academically but for the real challenges in the finance industry. While it’s true that the course’s niche focus and cost might require careful consideration, the potential career advancements and mastery in financial modeling techniques specific to banking justify the investment. If you’re aiming for a role in investment banking or finance that demands a deep understanding of regulatory frameworks and financial modeling, this course might be the key to revealing those doors.

Frequently Asked Questions

What is the focus of the BIWS Bank & Financial Institution Modeling course?

The BIWS Bank & Financial Institution Modeling course is specially designed to cover banking and financial modeling, with a strong emphasis on practical case studies and understanding regulatory frameworks like Basel III. It prepares individuals for careers in finance by teaching financial valuation and merger models specific to the banking sector.

Who should consider taking the BIWS Bank & Financial Institution Modeling course?

This course is ideal for those aiming to break into investment banking, finance professionals seeking to advance their careers, and individuals wanting to master financial modeling techniques specific to banking. Its comprehensive content is geared towards those looking for in-depth knowledge and practical skills in financial institution analysis.

What are the pros and cons of the BIWS Bank & Financial Institution Modeling course?

Pros of the course include its in-depth content, real-world case studies, and comprehensive coverage of financial valuation and merger models. Cons might be its niche focus, which limits the breadth of general finance topics covered, and potential costs associated with enrollment.

How does the BIWS course help in career advancement?

The course has been instrumental in career advancements for many, with success stories highlighting job placements in prestigious financial institutions. Graduates have praised the course for its role in mastering financial modeling techniques and preparing for significant roles in the finance industry through practical case studies and flexible learning paces.

Can the BIWS course prepare me for understanding complex regulatory frameworks?

Yes, the course includes detailed case studies that are pivotal in understanding complex regulatory frameworks like Basel III. It is designed to prepare graduates for roles in finance that require knowledge of these regulations, making it a valuable resource for professionals aiming to navigate the intricacies of financial compliance and regulation.