Rene Le Cornu – Trade the Markets like a Professional

Have you ever wondered how some traders make consistent profits while others seem to always be struggling? The difference often lies in their understanding of market psychology, technical indicators, and trading strategy. But the journey to trading proficiency doesn’t have to come at the cost of countless losses.

Why This Course?

Cost-Effective Learning: The cost of learning doesn’t mean losing money on bad trades. Equip yourself market understanding to avoid common and costly trading pitfalls.

Master Market Psychology: Emotions play a critical role in trading. Our course delves deep into understanding market psychology, teaching you how to leverage and manage emotions to make sound trading decisions.

Expert Trading Strategies: Explore a plethora of trading strategies and find the one that suits your trading style and goals. Whether it’s trend-following, breakout trading, or long-term position trading, we’ve got you covered.

Risk Management Essentials: Learn how to protect your capital with risk management principles. Understand the nuances of position sizing, money management, and how they work together to safeguard your trading portfolio.

What You’ll Learn In Trade the Markets like a Professional

Introduction

Introduction to Trading

Trading Fundamentals

Economic Indicators and Their Impact on the Markets

Individual Company Financial Statements and Ratios

Conclusion

Charts

Different Types of Charts

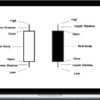

Interpreting Candle Stick Charts

Importance of Timeframes in Chart Analysis

Overview of Different Timeframes and Their Applications

Minute Charts

Hourly Charts

Daily Charts

Weekly Charts

Choosing the Right Timeframe for Your Trading Style

Introduction to Multi-Timeframe Analysis

Timeframes in Trading – A Top Down Approach

Timeframes in Trading – A Bottom Up Approach

Combining Timeframes for Better Trade Decisions

Timeframes in Trading – Summary

Interpreting Chart Patterns

Understanding Chart Patterns

Market Participants and Their Influence on Market Psychology

Single Bar Patterns – Gaps and Windows

Single Bar Patterns – Doji Candlestick Patterns

Single Bar Patterns – Hanging Man Candlestick Pattern

Single Bar Patterns – Shooting Star Candlestick Pattern

Single Bar Patterns – Hammer and Inverted Hammer

Market Psychology of Chart Patterns

Identifying Market Trends

Trend Indicators

Support and Resistance Levels

Types of Trends

Trend Direction

Market Sentiment: Understanding Bullish, Bearish, and Neutral Market Psychology

Basic Trend Trading Strategies

Support and Resistance

Understanding the Basics of Support and Resistance.

Types of Support and Resistance

Importance of Support and Resistance in Trading

Market Psychology behind Support and Resistance Levels

Analyzing Candlestick Patterns at Support and Resistance Levels

Setting Entries and Exits Using Support and Resistance

Setting Risk Limits for Support and Resistance Trades

Implementing Support and Resistance Strategies: Bounce Trading Strategy

Implementing Support and Resistance Strategies: Breakout Trading Strategy

Implementing Support and Resistance Strategies: Fakeout Trading Strategy

Combining Support and Resistance Strategies for Optimal Results

Technical Indicators

Introduction to Technical Indicators and Market Psychology

Moving Averages

Moving Averages – Traders Thoughts

Fibonacci Retracements

Oscilators

What is an Oscillator

The Relative Strength Index (RSI)

The Stochastic Oscillator

Moving Average Convergence Divergence (MACD)

The Commodity Channel Index (CCI)

Williams Percent Range

Generating Entries with Oscillators

Understanding the Use of Oscillators in Trading

Trading Strategies

Introduction to Trading Psychology Techniques

Trend-Following

Break Out Trading

Chart Pattern Breakouts

Volatility Breakouts

Counter-Trend Trading

Divergences

Oscillator Overbought/Oversold Conditions

Range Trading

Support & Resistance Bounces

Moving Average Crossovers

Day Trading

Scalping

Momentum Trading

Swing Trading

Moving Average Pullbacks

Long-term Trend Following

Fundamental Analysis

Long Term Position Trading

Algorithmic Trading

Bollinger Bands Squeeze

Fibonacci Retracements & Extensions

Conclusion

Risk Management

Importance of Risk Management in Trading

Introduction to Position Sizing and Money Management in Trading

How Position Sizing and Money Management Work Together

The Need for Adaptability and Flexibility

Position Sizing and Risk Management

Risk Management – Final Thoughts

Market Psychology and Trading

The Role of Market Psychology in Trading

Emotions in Trading

Fear and greed

Optimism and pessimism

Euphoria and panic

The Four Key Emotions Fear, Greed, Hope, and Regret

The Impact of Fear on Trading Decisions

The Impact of Greed on Trading Decisions

The Impact of Hope on Trading Decisions

The Impact of Regret on Trading Decisions

Overcoming Emotional Barriers in Trading

Building Emotional Resilience in Trading

Building a Strong Trading Mindset

Stress in Trading

Avoiding Impulsive Trades

Developing a Consistent Trading Approach and Discipline

Goal Setting

Journaling

Visualization

Mindfulness

Developing a Trading Strategy

Introduction

Step 1 – Identify Your Trading Goals

Step 2 – Choose a Trading Method

Step 3 – Develop a Trading Plan

Step 4 – Backtesting

Step 5 – Forward Testing

Step 6 – Refine and Optimize Your Strategy

Order Types and Execution

Develop Your Trading Plan

Goals, Style and Strategy

Creating a Trading Plan and Sticking to It

Key Components of a Trading Plan

Importance of Adaptability in Trading

Monitoring Market Conditions

Adapting to New Market Conditions

Developing a trading plan that accounts for market psychology

Techniques for managing emotions while trading

Live Trading and Portfolio Management

Live Trading and Portfolio Management

Conclusion

Summary

The Ongoing Journey to Mastering Market Psychology and Technical Indicators

Embracing Adaptability and Growth in Your Trading Approach

Case Studies: Successful Traders and Their Use of Market Psychology and Technical Indicators

Trading Rules to Remember