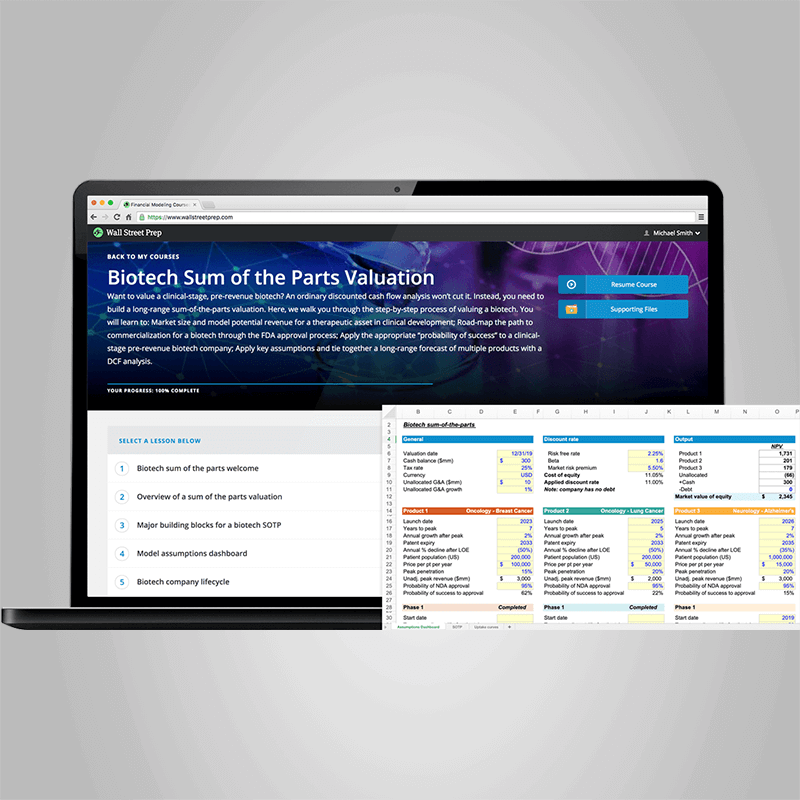

Biotech Sum of the Parts ValuationBiotech Sum of the Parts Valuation19 Lessons1h 18m68,321 StudentsIdeal for investment banking private equity and VC professionals focusing on the biotechnology industry, you will learn how to build a biotech-sum-of-the-parts valuation the way it’s done on the job.Real World “On the Job†Biotech SOTP ValuationWhat You’ll LearnMarket size and model potential revenue for a therapeutic asset in clinical developmentRoad-map the path to commercialization for a biotech through the FDA approval processApply the appropriate “probability of successâ€â€ to a clinical-stage pre-revenue biotech companyApply key assumptions and tie together a long-range forecast of multiple products with a DCF analysisWant to value a clinical-stage, pre-revenue biotech? An ordinary discounted cash flow analysis won’t cut it. Instead, you need to build a long-range sum-of-the-parts valuation.This 60-minute video short course + model template bridges the gap between academics and the real world and equips trainees with the practical modeling skill set needed to build a biotech SOTP Valuation.This course assumes no prior knowledge in biotech company valuation.Excel Model Template Included: A biotech sum-of-the-parts (SOTP) model template is included with this courseWho is this program for?This biotech sum-of-the-parts valuation course is designed for professionals and those pursing a career in the following finance careers:Investment BankingVenture CapitalPrivate Equity+ Anyone who wants to learn how professionals build a biotech-sum-of-the-parts valuationWall Street Prep’s Biotech Sum of the Parts Valuation is used at top financial institutions and business schools.Course SamplesProbability of successValuation sensitivitiesExample: Blueprint Medicines CorpPrerequisitesThis course does not assume a prior background in Biotech or Healthcare. However, those who enroll should have an introductory knowledge of accounting (e.g. interaction of balance sheet, cash flow, and income statement) and proficiency in Excel. Students with no prior background in Accounting should enroll in the Accounting Crash Course. Students with limited experience using Excel should enroll in the Excel Crash Course.Course ExtrasTaught by bankersOur instructors are former investment bankers who give lessons real-world context by connecting it to their experience on the desk.Used on the StreetThis is the same comprehensive course our corporate clients use to prepare their analysts and associates.Free Unlimited Access to the WSP Support CenterReceive answers to questions, free downloads, and more from our staff of experienced investment bankersCourse TOCBiotech Sum of the Parts Valuation1 Biotech SOTP course welcome 2:232 Biotech SOTP introduction 2:233 Overview of a sum of the parts valuation 1:504 Major building blocks for a biotech SOTP 3:425 Model assumptions dashboard 2:256 Biotech company lifecycle 5:407 Identify peak revenue opportunity 4:188 Therapeutic areas overview 1:059 Product launch timing and uptake curve 4:2710 Patent life and loss of exclusivity 2:2211 Road to commercialization 1:4812 FDA clinical trials 9:3213 Building a commercial infrastructure 3:0414 Completing the SOTP 0:1715 Probability of success 3:4516 Build out one part of the SOTP (Product #1) 17:3517 Finalizing the valuation model 1:2918 Valuation sensitivities 5:1919 Example: Blueprint Medicines Corp 4:41

Base Camp Trading – Futures Spreads Crash Course

₹16,434.00

Base Camp Trading – Futures Spreads Crash Course

₹16,434.00

Basecamptrading – Bond Trading Success

₹3,154.00

Basecamptrading – Bond Trading Success

₹3,154.00

Biotech Sum of the Parts Valuation

₹7,802.00