Opening Up Trading Markets: Understanding the Quantamentals Method

Overview

The fusion of quantitative analysis and fundamental insights in the ever-changing world of financial markets has resulted in the potent tactic known as Quantamentals. Fundamentally, Quantamentals offers investors a distinct and all-encompassing approach to trading by skillfully fusing the depth of fundamental research with the accuracy of quantitative analysis. This piece delves into the complexities of Quantamentals and examines how it may revolutionize trading for those looking for a competitive advantage.

Comprehending Quantamentals

How to Define Quantamentals

A trading technique known as “quantamentals,†a combination of the terms “quantitative†and “fundamentals,†capitalizes on the advantages of each method. Fundamental analysis explores a company’s underlying financial performance and health, whereas quantitative analysis depends on statistical methods and mathematical models. Because of the combination of these approaches in Quantamentals, traders are able to make well-informed selections by taking into account both the qualitative and quantitative characteristics of a securities.

Quantamentals’ Ascent in Trading Markets

One major participant in the financial information space, TradingMarkets, has aggressively adopted the Quantamentals methodology. They have put together an abundance of tools to provide traders the skills they need to handle the complexity of Quantamentals as they understand that a nuanced approach is necessary in today’s markets.

Gaining Proficiency in Quantitative Analysis

Quantitative Measurements in the TradingMarkets Methodology

TradingMarkets uses a variety of quantitative indicators to assess stocks in the field of quantamentals. From volatility measurements to statistical arbitrage models, these indicators give a deep knowledge of market dynamics. Traders may use this data to evaluate risk, spot trends, and manage their portfolios more effectively.

Trading Strategies Using Algorithms

The use of Quantamentals-based algorithmic trading algorithms is the key to TradingMarkets’ success. These quantitative model-driven automated strategies conduct transactions at the best times to reduce human error and take advantage of market inefficiencies. A more methodical and deliberate approach to trading is the end outcome.

Dissecting Basic Analysis

Examining Finances in More Detail

Although quantitative research offers a numerical representation, TradingMarkets recognizes the pivotal significance of fundamental analysis. Traders obtain a comprehensive understanding by examining a company’s financial records, earnings reports, and industry positioning. They are able to go beyond simple statistical patterns and make well-informed judgments because to this thorough understanding.

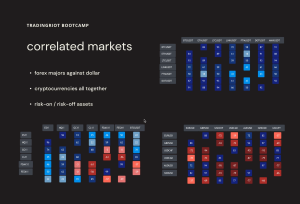

Market Influences and Economic Indicators

TradingMarkets differentiates itself by including both wider market impacts and economic data into its Quantamentals framework. This comprehensive strategy recognizes the interdependence of international markets and guarantees that traders are ready for changes in the macroeconomy that may have an effect on their holdings.

Handling Unpredictability with Quantamentals

Using Volatility to Your Advantage

Volatility in the constantly shifting financial markets is both a difficulty and an opportunity. The Quantamentals method from TradingMarkets gives traders the tools they need to handle market volatility strategically. Traders may benefit handsomely from volatility by utilizing quantitative algorithms and spotting trends.

Techniques for Risk Management

Effective risk management is essential to any trading strategy’s success. TradingMarkets is exceptional in this regard as they incorporate tactics for mitigating risk into their Quantamentals structure. Traders can actively participate in volatile market circumstances while protecting their wealth using stop-loss systems or position size algorithms.

In summary

For traders looking to remain ahead of the curve in the dynamic world of financial markets, knowing the Quantamentals strategy is essential. With its dedication to provide innovative perspectives and resources, TradingMarkets serves as a guiding light for anyone attempting to effectively negotiate the intricacies of Quantamentals. Traders can open up new avenues and improve their trading skills by skillfully combining quantitative research and fundamental insights.

TradingMarkets – Programming in Python For Traders

₹24,900.00

TradingMarkets – Programming in Python For Traders

₹24,900.00

Tradingriot Bootcamp + Blueprint 3.0

₹4,980.00

Tradingriot Bootcamp + Blueprint 3.0

₹4,980.00

TradingMarkets – Quantamentals

₹4,150.00