This led to our mannequin portfolio considerably outperforming the sector and lots of of our picks ended up being acquired by bigger gold mining firms at vital premiums. File Dimension: 94.71 MB

Jason Hamlin – Gold Stock Bull

The subscription additionally covers industrial metals, battery metals, power metals and some other sort of metallic or mining inventory the place we spot a possibility to revenue.

It has been revealed by Jason Hamlin each month persistently for the previous 14 years and receives prime rankings from subscribers all over the world.

We first began masking the rising bull market in gold and silver within the early 2000’s. However relatively than simply advocate shopping for gold or the nicely-identified miners, we centered on recommending up-and-coming junior and mid-tier mining shares earlier than the remainder of the market took discover.

This led to our mannequin portfolio considerably outperforming the sector and lots of of our picks ended up being acquired by bigger gold mining firms at vital premiums.

Subscribe to Gold Stock Bull

Your Subscription Consists of:

Month-to-month E-newsletter with Detailed Basic and Technical Analysis

Actual-Time Portfolio and Worth Targets With Our High Stock Picks

Weekly Purchase/Promote Commerce Alerts with Rationale for Every Commerce

Jason’s Private Electronic mail with 24-Hour Response to All Questions

Early & Latest Stock Decide Positive factors

455%

Bema Gold

Certainly one of our earliest picks was Bema Gold, which we purchased beneath $1 per share. It was later acquired by Kinross Gold for $5.35 per share in a $3.1 billion deal, netting us a return of 435%!

295%

Wheaton River Minerals

We additionally beneficial Wheaton River Minerals beneath $1 per share. It was quickly acquired by Goldcorp at $3.60 per share in a deal valued at over $2 billion, netting us a 295% return!

692%

Silver Wheaton

In 2009, we beneficial Silver Wheaton at $5.92 per share. It soared to a excessive of $46.91, simply two years after our entry level for a return of 692%!

602%

OceanaGold

We additionally beneficial OceanaGold in early 2009 at $0.54 and it climbed to $3.79 in lower than two years. This represents a acquire of 602% in simply 18 months!

1,069%

SEMAFO, Inc.

After taking a visit to their Montreal places of work in early 2009 and assembly with their CEO, we ended up recommending SEMAFO, Inc. at $1.17 per share. By November of 2010, shares had rocketed to $13.68 every for a acquire of 1,069%!

What different profitable buyers are saying:

After solely somewhat over a month invested in various the positions beneficial, my Gold Stock Bull ETF of types than I constructed is up 30% since inception. Jason provides updates on any commerce he makes plus a month-to-month e-newsletter. He additionally posts a portfolio the place you’ll be able to observe all of his solutions along with his allocation and efficiency for every suggestion. I’m a giant fan.

– B. Cortright

Yahoo Finance

investing.com

Searching for Alpha

equities.com

Constant Outcomes, No Matter the Market

We don’t simply generate some of these spectacular beneficial properties throughout bull markets. Our methods persistently outperform the market throughout bear markets or durations of consolidation and sideways buying and selling.

Get instantly obtain Jason Hamlin – Gold Stock Bull

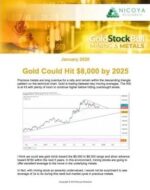

The chart exhibits the efficiency of our mannequin portfolio since its inception in 2006. Our picks have returned 4,008% for subscribers versus a return of 157% from investing within the Dow Jones Industrial Common. The common annual return has been 47% versus 8% for the Dow!

Nicoya Analysis Portfolio Returns

Nicoya Analysis Portfolio Returns

In 2016, we beneficial our present #1 gold mining inventory decide at $5.66. In simply over two years, the share worth has risen to over $47 per share. That may be a return of 730%, throughout a time when the gold worth superior by solely 3.5%.

Merely put, selecting an organization with strong administration, rising manufacturing, declining prices and a constant historical past of accretive acquisitions issues relating to maximizing your returns.

Do not Miss the Subsequent Cycle

We consider that the dear metals market is on the early levels of its subsequent main bull cycle and this represents an unbelievable alternative to purchase high quality miners on a budget whereas only a few buyers have an interest. This subsequent bull cycle ought to take gold to new highs above $2,000 per ounce and silver above $50 per ounce. In such an setting, high quality mining shares are going to supply big leverage and make large quantities of cash for buyers prepared to purchase early.

Quarterly Plan

$195 /Quarter

Month-to-month E-newsletter

Actual Time Portfolio

Electronic mail Commerce Alerts

Renews Quarterly

Cancel Anytime

Signal Up Now!

Yearly Plan

$495 /12 months

Month-to-month E-newsletter

Actual Time Portfolio

Electronic mail Commerce Alerts

Renews Yearly

1 12 months Dedication

Signal Up Now!

Mastermind Membership

$995 /12 months

All 4 Newsletters

All 4 Portfolios

All 4 Commerce Alerts

Buying and selling Chat Room

Video Updates

Precedence Help