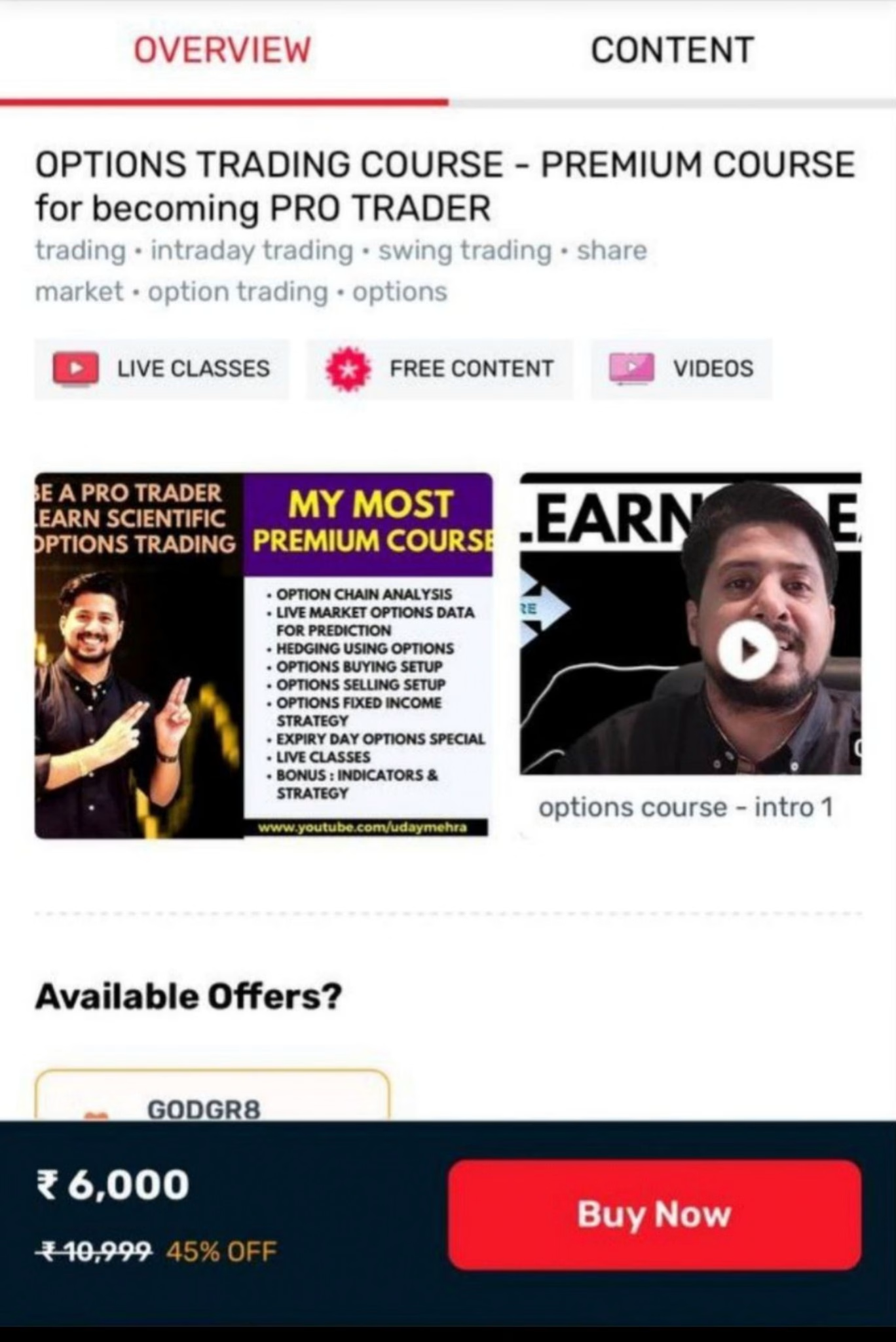

Nifty Prediction Option Trading Course By Uday Mehra

Total Vidoes:- 11

Quality:- HD

Lifetime access

Only for Today 53.00% Discount on All Order . Use Code : SAVE53 Dismiss

Dr. Fx Smc Course 2022

Dr. Fx Smc Course 2022

Harshubh Shah Financial Astrology For Beginners Course

Harshubh Shah Financial Astrology For Beginners Course

Original price was: ₹6,000.00.₹249.00Current price is: ₹249.00.

-96%After Doing Payment, Please Contact us on telegram. For Course Delivery ✅